You are here:Norfin Offshore Shipyard > block

Would Mining Bitcoin Gold Be Profitable?

Norfin Offshore Shipyard2024-09-21 00:40:27【block】6people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the cryptocurrency market has seen a surge in popularity, with Bitcoin being the mo airdrop,dex,cex,markets,trade value chart,buy,In recent years, the cryptocurrency market has seen a surge in popularity, with Bitcoin being the mo

In recent years, the cryptocurrency market has seen a surge in popularity, with Bitcoin being the most well-known digital currency. As the demand for Bitcoin continues to grow, many individuals are considering mining as a way to earn Bitcoin. One of the newer cryptocurrencies that has gained attention is Bitcoin Gold (BTG). But would mining Bitcoin Gold be profitable?

Firstly, it is important to understand what Bitcoin Gold is. Bitcoin Gold is a fork of Bitcoin that was created in 2017. The main difference between Bitcoin and Bitcoin Gold is the mining algorithm. Bitcoin uses the SHA-256 algorithm, while Bitcoin Gold uses the Equihash algorithm. This change was made to make mining more accessible to individuals with regular computers, as the SHA-256 algorithm requires specialized hardware.

The profitability of mining Bitcoin Gold depends on several factors. One of the most crucial factors is the cost of electricity. Mining requires a significant amount of power, and the cost of electricity can vary greatly depending on the location. In areas where electricity is cheap, mining Bitcoin Gold can be more profitable. However, in regions where electricity costs are high, the potential profit may be reduced.

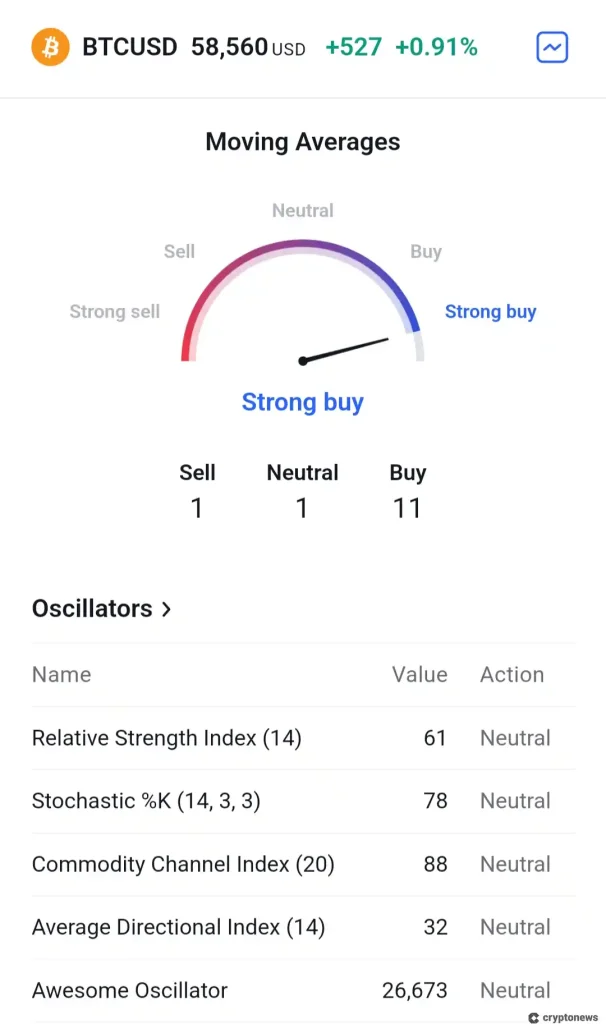

Another factor to consider is the current market price of Bitcoin Gold. The price of Bitcoin Gold can fluctuate significantly, and this can directly impact the profitability of mining. When the price of Bitcoin Gold is high, the potential profit from mining increases. Conversely, when the price is low, the potential profit decreases. It is essential to keep an eye on the market trends and make informed decisions based on the current price.

The difficulty level of mining is also a critical factor. The difficulty level measures how hard it is to mine a new block of Bitcoin Gold. As more miners join the network, the difficulty level increases, making it more challenging to mine new coins. This means that the profitability of mining can decrease over time as the difficulty level rises. It is important to stay updated on the difficulty level and adjust mining efforts accordingly.

Mining hardware is another aspect to consider. The performance of your mining rig can significantly impact your profitability. A more powerful rig can mine more coins in a shorter amount of time, but it also requires more electricity and investment. It is essential to find a balance between the cost of the hardware and the potential profit it can generate.

Lastly, the mining pool you choose can also affect your profitability. Mining pools are groups of miners who work together to increase their chances of finding a block. By joining a mining pool, you can share the rewards with other miners. However, some mining pools may charge fees, which can reduce your overall profit.

In conclusion, would mining Bitcoin Gold be profitable? The answer depends on various factors, including the cost of electricity, market price, difficulty level, mining hardware, and the mining pool you choose. It is essential to conduct thorough research and consider these factors before deciding to mine Bitcoin Gold. While it is possible to earn a profit from mining Bitcoin Gold, it is not guaranteed, and it requires careful planning and management.

This article address:https://www.norfinoffshoreshipyard.com/blog/75f94198983.html

Like!(718)

Related Posts

- Bitcoin Mining Equipment Price: A Comprehensive Guide

- How to Buy Ethereum with Binance US Credit Card

- HTR Coin Binance: The Future of Cryptocurrency Trading

- The MT Gox Bitcoin Wallet: A Brief History and Its Impact on the Cryptocurrency World

- Best Way to Cash Out Bitcoin: A Comprehensive Guide

- Buy Bitcoin Binance: A Comprehensive Guide to Purchasing Cryptocurrency on the Leading Exchange

- Litecoin Mining Difficulty vs Bitcoin: A Comprehensive Analysis

- Crypto Nieuws: Bitcoin Cash's Recent Developments and Implications

- Itbit Bitcoin Cash: A Comprehensive Guide to the Popular Cryptocurrency Platform

- Visa Bitcoin Wallet: Revolutionizing the Crypto Space

Popular

Recent

Bonanza Mine: An Ultra-Low-Voltage Energy-Efficient Bitcoin Mining ASIC

Max Keiser Best Bitcoin Wallet: A Comprehensive Guide

How Long Do Withdrawals Take on Binance.US?

Bitcoin Price Monthly Chart 2017: A Journey Through the Cryptocurrency's Evolution

Why Can't I Open a Binance Account?

What Do I Need to Open a Bitcoin Wallet?

Crypto Nieuws: Bitcoin Cash's Recent Developments and Implications

Bitcoin Sent Directly to Wallet with No Withdrawal Limit: A Game-Changing Innovation in Cryptocurrency

links

- New Crypto Listing on Binance: A Game-Changing Addition to the Platform

- The Rise of Venmo Bitcoin Cash: A New Era of Digital Transactions

- Will Bitcoin Cash Price Rise Again?

- Can I Spend Unconfirmed Bitcoin?

- How to Transfer ETH to Binance Smart Chain: A Step-by-Step Guide

- Binance Smart Chain USDC Contract Address: A Comprehensive Guide

- Trust Wallet Bitcoin Fees: Understanding the Cost of Secure Transactions

- **Maximizing Efficiency with Bitcoin Mining Hosting Services

- How to Get Cash in Hand from Bitcoin

- March 2019 Bitcoin Price: A Look Back at the Volatile Crypto Market