You are here:Norfin Offshore Shipyard > airdrop

Mining Bitcoin 2018: A Year of Challenges and Opportunities

Norfin Offshore Shipyard2024-09-20 15:21:39【airdrop】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In 2018, the world of cryptocurrency experienced a rollercoaster ride, with Bitcoin mining being at airdrop,dex,cex,markets,trade value chart,buy,In 2018, the world of cryptocurrency experienced a rollercoaster ride, with Bitcoin mining being at

In 2018, the world of cryptocurrency experienced a rollercoaster ride, with Bitcoin mining being at the forefront of this dynamic industry. As the year came to a close, many miners were left scratching their heads, wondering what the future held for mining Bitcoin. This article delves into the key events and challenges faced by Bitcoin miners in 2018.

One of the most significant developments in the Bitcoin mining landscape in 2018 was the increase in the difficulty of mining. As more miners joined the network, the difficulty level of mining Bitcoin soared, making it increasingly challenging for individual miners to turn a profit. This trend was evident throughout the year, with the difficulty level reaching new heights in May and June.

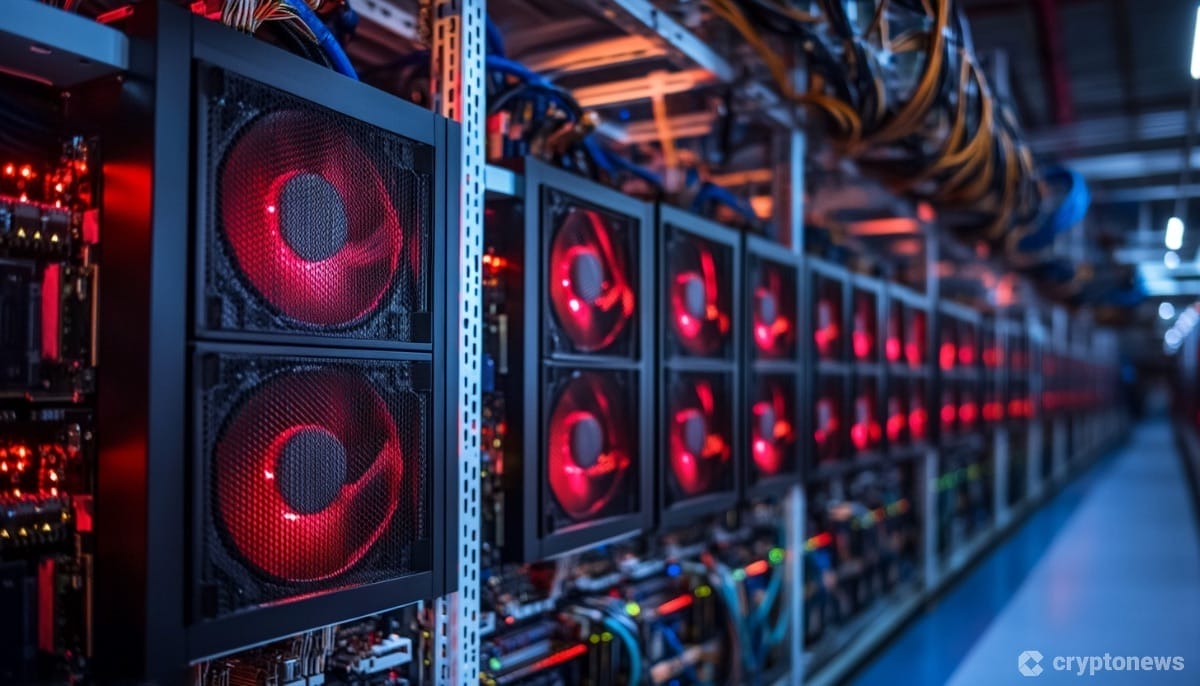

Despite the rising difficulty, many miners continued to invest in new and more efficient mining hardware. The introduction of ASIC (Application-Specific Integrated Circuit) miners, which are designed specifically for mining Bitcoin, played a crucial role in this shift. These specialized devices offered higher hash rates and lower power consumption, making them more attractive to miners looking to maximize their profits.

However, the high cost of these ASIC miners was a significant barrier for many individual miners. The initial investment required to purchase an ASIC miner could be upwards of $2,000, and the ongoing electricity costs further added to the financial burden. This led to a consolidation of the mining industry, with larger players and mining pools gaining more prominence.

Another challenge faced by Bitcoin miners in 2018 was the volatility of the cryptocurrency market. The value of Bitcoin fluctuated wildly throughout the year, making it difficult for miners to predict their profits. While the price of Bitcoin reached an all-time high of nearly $20,000 in December 2017, it plummeted to around $3,200 by the end of 2018. This volatility created uncertainty and forced miners to adapt their strategies accordingly.

One of the most notable events in the Bitcoin mining space in 2018 was the launch of the Bitcoin Cash hard fork. This event led to the creation of two separate cryptocurrencies: Bitcoin and Bitcoin Cash. While Bitcoin Cash initially experienced a surge in value, it eventually settled at a much lower level than Bitcoin. This split highlighted the potential risks associated with mining Bitcoin, as any future forks could have a significant impact on the profitability of miners.

Despite the challenges, 2018 also presented opportunities for Bitcoin miners. The rise of cloud mining services allowed individuals to participate in mining without the need for expensive hardware or electricity costs. These services provided a convenient and cost-effective way for miners to earn Bitcoin, although they came with their own set of risks, such as the potential for service providers to go out of business.

In conclusion, 2018 was a year of challenges and opportunities for Bitcoin miners. The rising difficulty of mining, the volatility of the cryptocurrency market, and the high cost of ASIC miners presented significant obstacles. However, the introduction of cloud mining services and the potential for future forks provided some hope for miners looking to turn a profit. As the industry continues to evolve, it remains to be seen how Bitcoin miners will navigate the ever-changing landscape of mining Bitcoin 2018 and beyond.

This article address:https://www.norfinoffshoreshipyard.com/blog/15f28499700.html

Like!(838)

Related Posts

- Buying Bitcoins with Cash in the UK: A Comprehensive Guide

- The Price of Bitcoin at the Beginning: A Journey Through Time

- The Price of Bitcoin at the Beginning: A Journey Through Time

- Banks in the Netherlands Launches Bitcoin Wallet: This is HUGE

- Bitcoin Price Forecast 2023: What to Expect in the Coming Year

- ### Launch a Coin on Binance Smart Chain: A Comprehensive Guide

- Bitcoin Mining to End 2018: A Look Back and a Glimpse into the Future

- Where to Track Bitcoin Price: A Comprehensive Guide

- **The Current State of the Prijs van Bitcoin Cash

- Bitcoin Mining with Blockchain: A Revolutionary Technology

Popular

Recent

Title: A Step-by-Step Guide to Login to My Bitcoin Wallet

What Was the Price of Bitcoin in the Beginning?

Title: Enhancing Your Bitcoin Mining Efficiency with the Bitcoin Mining Calculator Excel

VPN Bitcoin Mining: A Secure and Profitable Approach

Understanding Bitcoin Wallets: The Ultimate Guide to Securely Managing Your Cryptocurrency

Who Can Trade on Binance: A Comprehensive Guide

Install Bitcoin Wallet on Linux Mint: A Step-by-Step Guide

Where to Track Bitcoin Price: A Comprehensive Guide

links

- Cash App Bitcoin Transaction History: A Comprehensive Guide

- How to Claim Your Ethereum Forked Coins with Binance

- What is 2FA Code from Binance App?

- Binance Chain Centralized: The Controversy and Its Implications

- Binance Chain Centralized: The Controversy and Its Implications

- Bitcoin Cash in Cash Out: A Comprehensive Guide

- Bitcoin Cash ABC vs SV Price: A Comprehensive Analysis

- Can You Withdraw from Binance US to Bank Account?

- Title: Enhancing Cryptocurrency Management with the Smart Chain Binance Wallet

- How to Send USDT from Binance to Coinbase: A Step-by-Step Guide