You are here:Norfin Offshore Shipyard > trade

Why Bitcoin Price is Different on Different Exchanges

Norfin Offshore Shipyard2024-09-20 23:59:07【trade】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized cryptocurrency, has been a topic of great interest and deba airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized cryptocurrency, has been a topic of great interest and deba

Bitcoin, the world's first decentralized cryptocurrency, has been a topic of great interest and debate since its inception in 2009. One of the most frequently asked questions about Bitcoin is why its price is different on different exchanges. This article aims to explore the reasons behind this phenomenon.

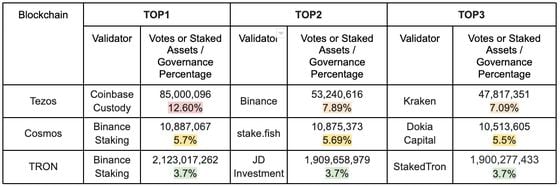

Firstly, it is important to understand that Bitcoin exchanges operate in different markets with varying levels of liquidity, trading volume, and geographical reach. Each exchange has its unique set of users, which can lead to differences in the supply and demand dynamics for Bitcoin. This is the primary reason why Bitcoin price is different on different exchanges.

1. Liquidity

Liquidity refers to the ease with which an asset can be bought or sold without causing a significant change in its price. Exchanges with high liquidity tend to have more traders and a larger order book, making it easier to execute trades at the current market price. In contrast, exchanges with low liquidity may experience larger price fluctuations due to limited trading volume.

When Bitcoin is traded on an exchange with high liquidity, the price tends to be more stable and close to the global average. However, on exchanges with low liquidity, the price may deviate significantly from the global average due to the scarcity of buyers and sellers.

2. Trading Volume

Trading volume is another crucial factor that influences the price of Bitcoin on different exchanges. Exchanges with high trading volume attract more attention from traders, which can lead to increased price volatility. In contrast, exchanges with low trading volume may experience less price movement.

When Bitcoin is traded on an exchange with high trading volume, the price is more likely to reflect the true market value of the asset. However, on exchanges with low trading volume, the price may be influenced by a few large orders, leading to significant price discrepancies.

3. Geographical Reach

The geographical reach of an exchange can also contribute to the differences in Bitcoin prices. Exchanges with a global user base tend to have more balanced supply and demand, resulting in a more stable price. On the other hand, exchanges with a limited geographical reach may experience price discrepancies due to varying levels of demand in different regions.

4. Regulatory Environment

The regulatory environment in each country can also impact the price of Bitcoin on different exchanges. Exchanges operating in countries with strict regulations may face limitations in terms of trading volume and liquidity, leading to price discrepancies. Conversely, exchanges in countries with a more lenient regulatory environment may experience higher trading volumes and liquidity, resulting in a more stable price.

5. Exchange Fees

Exchange fees can also contribute to the differences in Bitcoin prices. Exchanges with higher fees may attract fewer traders, leading to lower trading volume and liquidity. This can result in price discrepancies compared to exchanges with lower fees.

In conclusion, the reasons why Bitcoin price is different on different exchanges can be attributed to factors such as liquidity, trading volume, geographical reach, regulatory environment, and exchange fees. Understanding these factors can help traders make more informed decisions when trading Bitcoin across various exchanges.

This article address:https://www.norfinoffshoreshipyard.com/blog/13d91099076.html

Like!(9351)

Previous: The Benefits of Mining Bitcoin

Related Posts

- Does Mining Bitcoin Damage Your Computer?

- Bitcoin Price Estimate 2017: A Look Back at the Cryptocurrency's Journey

- Bitcoin Historical Price JPY: A Comprehensive Analysis

- Bitcoin Cash Investopedia: Understanding the Cryptocurrency and Its Investment Potential

- When is Binance Listing Pepe: A Comprehensive Guide

- ### Ledger Bitcoin Wallet Crash: A Closer Look at the Incident and Its Implications

- **Understanding the Icon Binance Withdrawal Process

- What Cryptocurrency Clearinghouses Support Bitcoin Cash?

- What is Bitcoin Cash Address?

- Bitcoin Green Energy Mining: A Sustainable Approach to Cryptocurrency

Popular

Recent

Bitcoin ABC Wallet Safe: Ensuring Secure and Reliable Cryptocurrency Storage

How to Trade Bitcoin for Cash on Coinbase: A Step-by-Step Guide

The Price of Bitcoin by End of 2021: A Comprehensive Outlook

Unlocking the Potential of Script Mining Bitcoin Free: A Comprehensive Guide

Title: Unveiling the Power of the Claim Bitcoin Wallet APK: A Comprehensive Guide

Bitcoin Cash Difficulty Rate: A Comprehensive Analysis

How to Transfer Bitcoin from Coinbase to a Wallet: A Step-by-Step Guide

Unlocking the Potential of Script Mining Bitcoin Free: A Comprehensive Guide

links

- Using Trust Wallet for Binance: How to Deposit

- Bitcoin Mining Compare Profitability: A Comprehensive Analysis

- Can I Send XRP to Binance? A Comprehensive Guide

- Binance AMP Listing: A Game-Changing Move in the Cryptocurrency Market

- NVIDIA GeForce GTX 1080 Bitcoin Mining: A Comprehensive Guide

- P2P Crypto Trading on Binance: A Comprehensive Guide

- Bitcoin Gold Mining Profit: A Comprehensive Guide

- How to Get Money from Binance to Trust Wallet: A Step-by-Step Guide

- NVIDIA GeForce GTX 1080 Bitcoin Mining: A Comprehensive Guide

- What Was the Bitcoin Price in 2014?